Business Credit Builder - Tips to Avoid Credit Errors.

- Amerishop Financial

- Jul 9, 2021

- 5 min read

Updated: Jan 31, 2022

Credit is a complicated creature. The second you think you have it figured out, it turns on you. Truly, if you don’t handle it just right, it can morph from powerful ally to mortal enemy in a flash. This is especially true if you are trying to run a business. Thankfully, the Amerishop Business Credit Builders can help in a big way.

3 Major Credit Blunders and How the Business Credit Builder Can Help

Across the ages, one major problem business owners face is funding. Funding is an issue that cuts across all industries, all owner experience levels, and all business entity types.

One reason business owners may have trouble finding funding is, they do not realize there are actually two types of credit. Not only is there personal credit, but there is also business credit. Once this simple revelation comes to light, the trajectory of the business can begin to change for the better. Personal finances do not have to suffer.

What is Business Credit?

Business credit is credit in the name of your business only. It is based on how likely the business is to repay bills, not the owner.

As a result, business credit accounts do not show up on your personal credit report. In fact, they do not affect your personal credit score at all. In addition, the business is responsible for repayment, not the owner.

Why Do You Need Business Credit?

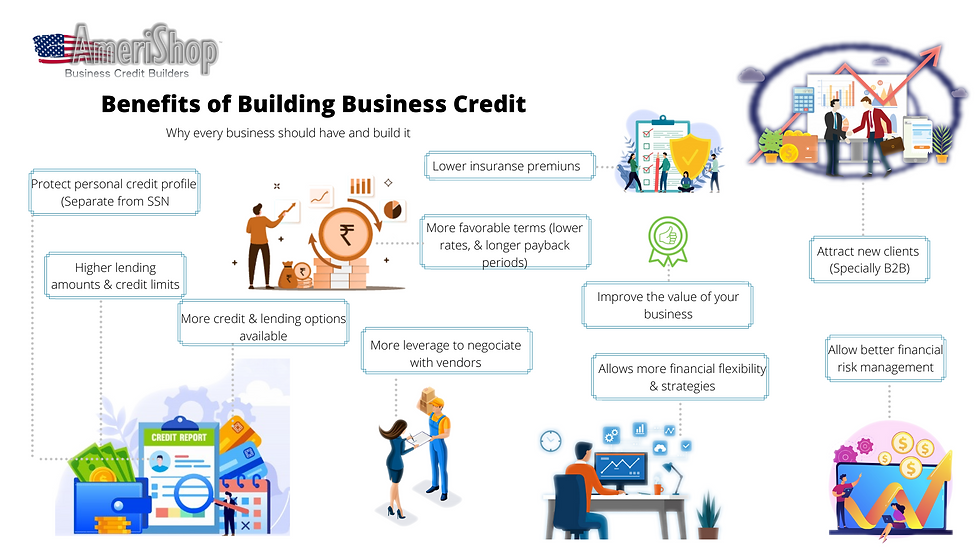

Few business owners understand all the benefits of business credit.

Some of these include:

Liability protection

Lower debt-to-credit ratio on your personal report

And higher credit limits

How the Business Credit Builder Can Help

So, how do you build business credit? How do you get accounts that are not connected to your personal credit? With the Amerishop Business Credit Builders of course! It sounds simple, but here is the thing. While building business credit is not necessarily hard, there are a lot of steps. It can be overwhelming without guidance.

This is where the business credit builder comes in. It can help guide you through the process. Even better, it can help you avoid these three major credit blunders, among others.

Blunder 1: Ruining Personal Credit with Business Debt

This is a huge problem. So many business owners do not know that they can get business credit without a personal guarantee. These are credit accounts that will not affect your personal credit profile should your business not be able to pay.

Of course, being personally on the line for business debt can cause a lot of issues. For an extreme example, consider the case of West Virginia Governor Jim Justice. He personally guaranteed over $700 million in loans for his coal company, Bluestone Resources. The loans were through Greensill Capital, which is now defunct. The downfall is due to an insurance carrier choosing to no longer underwrite funds for the popular finance company. As you can imagine, the domino effect is vast and far reaching.

Currently the impact on the Governor’s personal finances remains to be seen. However, it’s not hard to imagine the devastation something like this could wreak on a small business owner. Fortunately, working to build business credit with the Amerishop Business Credit Builders can help you avoid this type of credit blunder and protect your personal finances.

Blunder 2: Ignoring Fundability Factors

The first part of this is what you will work through in Step 1 of the Amerishop Business Credit Builders. It walks you through the process of building a foundation of fundability. After all, you wouldn’t build a house on a shaky foundation. You shouldn’t try to build business credit without a strong, fundable foundation either.

Blunder 3: Accounts Not Reporting

The only way to get a business credit score is to get accounts that will report to the business credit reporting agencies.

Honestly, this is tricky. With consumer credit, pretty much all accounts report payment history to your personal credit report. In contrast, only about 7% of companies that issue business credit report payments to business credit reports. Without this payment history, you do not have a business credit score.

What makes it harder is the fact that most companies that do report do not make that fact common knowledge. In fact, the only way to build business credit payment history on your own is through trial and error. You have to guess at which vendors will report your payments. And of course, there is the fact that you have to get accounts that will not only report, but that will extend business credit before you actually have a business credit score so that you can get started.

How the Amerishop Business Credit Builders Helps You Get Accounts Reporting

Step 2 helps you establish your initial business credit profile, so that accounts have something to actually report to.

Then, in Step 3 of the Amerishop Business Credit Builders, you will get exclusive access to starter vendors that will issue net invoices without checking credit. Then, they report your payments on those invoices to the business credit reporting agencies. We remove the need for trial and error and show you the exact accounts you can get to get the business credit score process going.

After enough of these types of accounts are reporting payments, you will qualify for more types of accounts.

Step 4 addresses this by showing you how to get copies of your business credit reports and see which accounts are reporting. You will also have the opportunity to review these reports with one of our expert advisors to learn more about what it says and how to address issues and mistakes.

How do you know when you have enough accounts reporting? How do you know which accounts to apply for next? Fortunately, the Business Credit Builder can guide you. In fact, this is your all-in-one tool for business business credit.

Steps 5-7 take you through the process of adding accounts to continue to build credit. As you gain enough accounts in each step, you will unlock access to vendors that will both approve you at your current step in the process and report your payments.

Other Benefits of the Amerishop Business Credit Builder

In addition to all of this, there are a number of other benefits to the program. For example, you will get free, unlimited use of a business valuation tool. This will allow you to see what your business is worth right now, and monitor its growth into the future.

You’ll also have the opportunity to save up to 90% on business credit monitoring, and have access to expert help. You’ll get a whole year of business advisor support and 5 years of finance officer support, all included!

Are You Ready to Get Started?

Honestly, the best way to get started is to call us at 1(800)927.5568 for a free consultation with a business credit expert. This is someone who can help you determine where your business is now, help you find financing, and help you determine if Business Credit Builder is right for you.

Comments